x

As it used to be, how today is meant to be

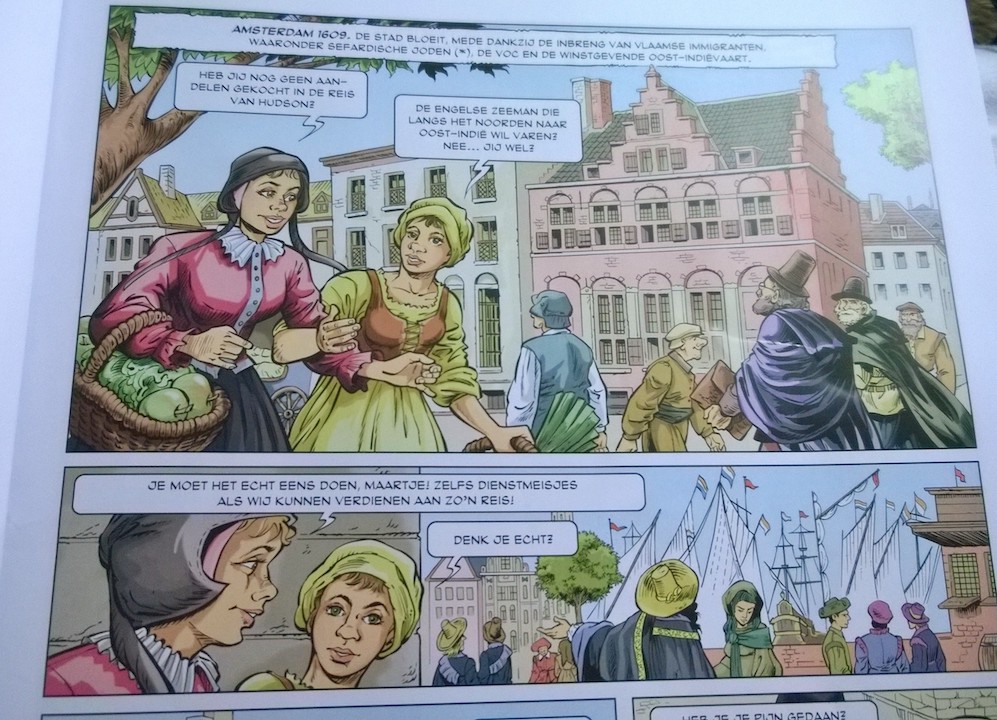

The Dutch Golden Age was a flourishing period with many Dutch Financial Innovations, most of which are used to this day or considered a standard in financial markets.

The first organisation to issue shares, as we know them, was the (Dutch) United East India Company (VOC), thereby creating their own marketplace for shares. Prior to the VOC there were numerous trading Companies from which the VOC was formed.

The most notable founders were Johan van Oldebarnevelt and Maurits van Nassau. This innovation and the underlying activities put the Netherlands on the map as a big trading nation for which it is known today.

This era of innovation brought new institutions, such as the Central Bank (DNB); new organizational form, such as the Limited Company, the Public Limited Company (Plc); and other novelties, such as the Dutch Auction and the Stock Exchange.

The VOC was structured in a way closest to what we know today as a Public Limited Company, however, without bearer-shares, the shareholders were registered and known. The success of the VOC’s Initial Public Offering (IPO), was largely caused by the fact that the offering was made available to the wider public and its owners were appointed as associates. Each Dutchman could buy and sell, i.e. trade their shares. From 1606, the term shareholder (aandeelhouder) was introduced. Moreover, investors could buy a share and pay for it in installments, if they wished.

On the “Dam”, in a bar, the purchases and sales of shares were recorded in a (share)register. Each shareholder received a paper receipt as evidence of payment (a “part”). The shares were freely tradeable, however, registered to the name of the buyer and undersigned with signatures of two directors. Due to the immense popularity of trading shares, the Merchant Exchange (Koopmansbeurs) was created in 1606, the predecessor of the Amsterdam Stock Exchange.In the past 400 years, the stock exchange has from many perspective changed little.

Noticeable, however, is the trading frequency of exchange listed equity, this changed dramatically. Share ownership used to be based on the underlying company and last for months and years, today the average share ownership lasts 22 seconds.

The creation of the Ltd. Company and the Plc. the barrier also become greater. Why is it that some organisations can be exchange listed to leverage their equity and others not?

All is explanatory and understandable from a historical perspective. In the end, the VOC was the cause of its own demise. By the end of the 17th century it became known with the public as “Vergaan Onder Corruptie”, which translates into “drown in corruption”.

With all that history teaches us and the benefit of hindsight as well today’s available resources and technologies, today one would have started from scratch differently. Exactly what we have done with Eyevestor. With the past knowledge and today’s means and desires establish a society relevant to the present and the future.

By creating equity liquidity, making shares more easily available and exchangeable to the wider public to finance your what you are good at, being invested with equality of risk and opportunity, you can change the culture and establish a more sound, just and equal society. Share to multiply is a known concept, now you can apply it.

Dare to share and the rest will follow. We are of the strong opinion that we can create a movement by democratising and liberalising equity in the real economy, for those that make a difference, considering how many companies there are and most people working in real economy companies. This mission is a culture shift, easily expressed – to turn equity into engaged equity and to ensure your equity wealth can be capitalised on. Are you in?!

Join Eyevestor

Join Eyevestor